Understanding Our Long Portfolio Strategies

Our Long Portfolio consists of multiple distinct strategies designed to identify and capitalize on upward price movements in the Nasdaq-100 futures market (commonly known as "NQ futures"). Each strategy operates within a specific timeframe but shares our core philosophy of systematic, rules-based trading enhanced by machine learning technology.

These strategies are all intraday, meaning positions are opened and closed within the same trading day, avoiding overnight market exposure and associated risks. By utilizing multiple timeframes, our portfolio aims to capture upside opportunities across various market conditions.

Strategy Performance

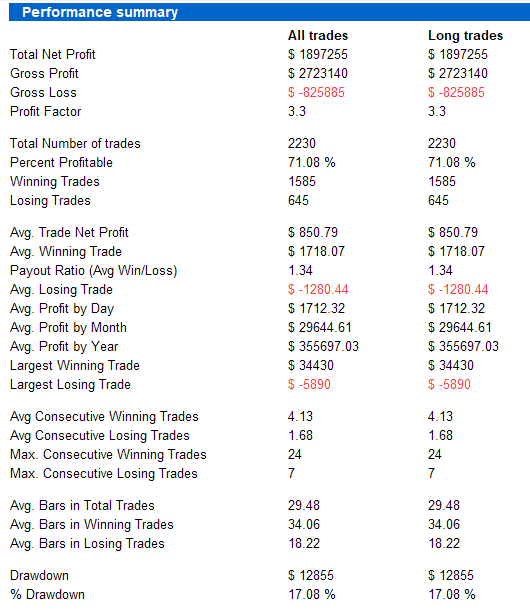

The strategy backtest results assumes trading 1 NQ contract with comissions and slippage included

Click the buttons below to view detailed backtest results for our portfolio of long strategies. Each report includes standard performance metrics that help evaluate strategy effectiveness.

Long Portfolio Performance

January 2020 - March 2025

Annual Return

$355,697

Average yearly profit

Profit Factor

3.3

Gross profit / gross loss

Win Rate

71.08%

1,585 winners / 2,230 trades

Max Drawdown

17.08%

$12,855 peak to trough

Comprehensive Performance Metrics

| Profitability Metrics | |

|---|---|

| Total Net Profit | $1,897,255 |

| Gross Profit | $2,723,140 |

| Gross Loss | $825,885 |

| Daily Average Profit | $1,712.32 |

| Monthly Average Profit | $29,644.61 |

| Trade Statistics | |

| Average Trade Net Profit | $850.79 |

| Average Winning Trade | $1,718.07 |

| Average Losing Trade | $1,280.44 |

| Reward/Risk Ratio (Avg Win/Loss) | 1.34 |

| Largest Winning Trade | $34,430 |

| Largest Losing Trade | $5,880 |

| Consistency Metrics | |

| Average Consecutive Winning Trades | 4.13 |

| Average Consecutive Losing Trades | 1.68 |

| Maximum Consecutive Winning Trades | 24 |

| Maximum Consecutive Losing Trades | 7 |

| Average Bars in Winning Trades | 34.06 |

| Average Bars in Losing Trades | 18.22 |

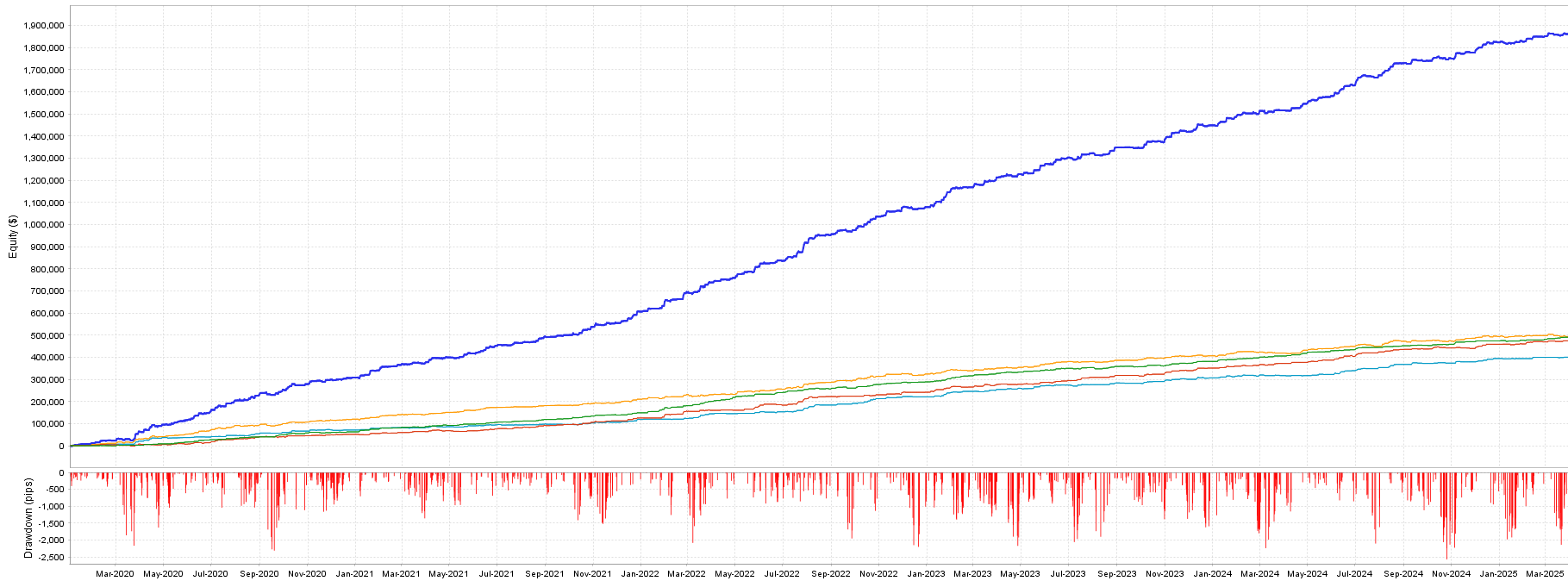

Investment Growth Example

$100,000 → $1,897,255

If you had invested $100,000 in this portfolio strategy in January 2020, it would have grown to approximately $1,897,255 by March 2025.

- That's an 18.97x return on your initial investment over 5.25 years

- Equivalent to approximately 79.7% compound annual growth rate

- Your investment would have experienced a maximum drawdown of $17,080 (17.08% of initial capital)

Note: Past performance is not indicative of future results. All trading involves risk of loss.

1,797% Total Return

Performance Comparison

Yearly Returns: Strategy vs. NQ Benchmark

| Year | Strategy Return (%) | NQ Return (%) | Outperformance (%) | $100K in Strategy | $100K in NQ |

|---|---|---|---|---|---|

| 2020 | 308.89% | 47.58% | +261.31% | $408,890 | $147,580 |

| 2021 | 298.19% | 26.63% | +271.56% | $398,190 | $126,630 |

| 2022 | 472.38% | -32.97% | +505.35% | $572,380 | $67,030 |

| 2023 | 369.46% | 53.81% | +315.65% | $469,460 | $153,810 |

| 2024 | 375.36% | 24.88% | +350.48% | $475,360 | $124,880 |

| 2025 (Q1) | 72.96% | -10.38% | +83.34% | $172,960 | $89,620 |

| Cumulative | 1,897.25% | 109.55% | +1,787.70% | $1,997,250 | $209,550 |

Monthly Performance Heatmap ($)

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 2,885 | 24,610 | 14,410 | 31,055 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 72,960 |

| 2024 | 38,150 | 14,670 | 15,145 | 29,485 | 35,030 | 48,035 | 45,915 | 54,420 | 11,490 | 11,240 | 25,515 | 46,270 | 375,365 |

| 2023 | 72,105 | 17,415 | 44,490 | 15,180 | 38,555 | 36,080 | 19,485 | 26,745 | -3,100 | 26,550 | 46,450 | 29,510 | 369,465 |

| 2022 | 45,615 | 43,545 | 42,375 | 21,130 | 52,490 | 23,145 | 83,415 | 33,925 | 22,585 | 61,510 | 39,345 | 3,305 | 472,385 |

| 2021 | 32,285 | 24,785 | 9,460 | 24,830 | 18,050 | 34,450 | 12,935 | 29,400 | 5,820 | 37,175 | 17,485 | 51,715 | 298,190 |

| 2020 | 12,890 | 11,245 | 40,815 | 31,100 | 20,375 | 39,975 | 48,850 | 28,375 | 22,550 | 25,375 | 20,160 | 9,180 | 308,890 |

Key Performance Insights

Strategy Highlights

- The strategy has significantly outperformed the NQ benchmark every year

- Most impressive outperformance was in 2022 (+505.35%), when NQ experienced a substantial decline

- Consistent positive performance across different market conditions

- 2022 was the best year with 472.38% return

- Only 1 negative month (September 2023) across the entire backtest period

Growth Comparison

If you had invested $100,000 at the beginning of 2020:

Strategy Value

$1,997,250

NQ Benchmark Value

$209,550

Understanding how our backtests are conducted is crucial for proper interpretation of results:

- Historical data: Testing uses tick-by-tick historical NQ futures data

- Transaction costs: All results include realistic commission and slippage estimates

- Out-of-sample validation: Strategies are developed on training data and validated on separate testing data to reduce overfitting

- Risk management: All strategies incorporate strict risk management parameters